Decoding the Terra Luna UST Crypto Crash of May 2022: Unveiling the Causes and Cryptocurrency Ramifications

In May 2022, Terra, a renowned blockchain protocol facilitating decentralized stablecoins pegged to fiat currencies, experienced a catastrophic event, resulting in over a 99% loss in value. This incident triggered one of the most severe collapses in recent crypto market history, prompting scrutiny into the causes and implications on stablecoins and crypto decentralization.

Key Insights into the Terra Luna UST Crypto Crash:

Magnitude of the 2022 Crypto Crash:

The second week of May witnessed a substantial downturn in the cryptocurrency market, with flagship assets Bitcoin and Ethereum shedding nearly 40% of their values. The overall crypto market lost over $600 billion during this tumultuous period, creating a wave of panic selling and widespread liquidations.

Terra's Role in the Crash:

Amid global economic challenges, Terra emerged as a focal point, experiencing a staggering loss of over 99% of its value. This blockchain platform, known for its algorithmic stablecoin TerraUSD (UST), suffered a collapse that exacerbated the broader crypto market sell-off, impacting investor confidence.

Understanding Algorithmic Stablecoins:

Terra's UST differs from traditional stablecoins like USDT and USDC by employing algorithms and Bitcoin reserves instead of direct fiat backing. This decentralized approach aims to address transparency issues associated with centralized stablecoins, offering a more resilient and transparent financial system.

The Terra Network's Mechanism:

Terra mints its native cryptocurrency, LUNA, through network verification. To create UST stablecoins, LUNA is burned or swapped, with the burning mechanism designed to be deflationary. Traders were incentivized to burn LUNA for UST through a high-yield staking offer, contributing to UST's popularity.

UST Peg Defense with Bitcoin Reserves:

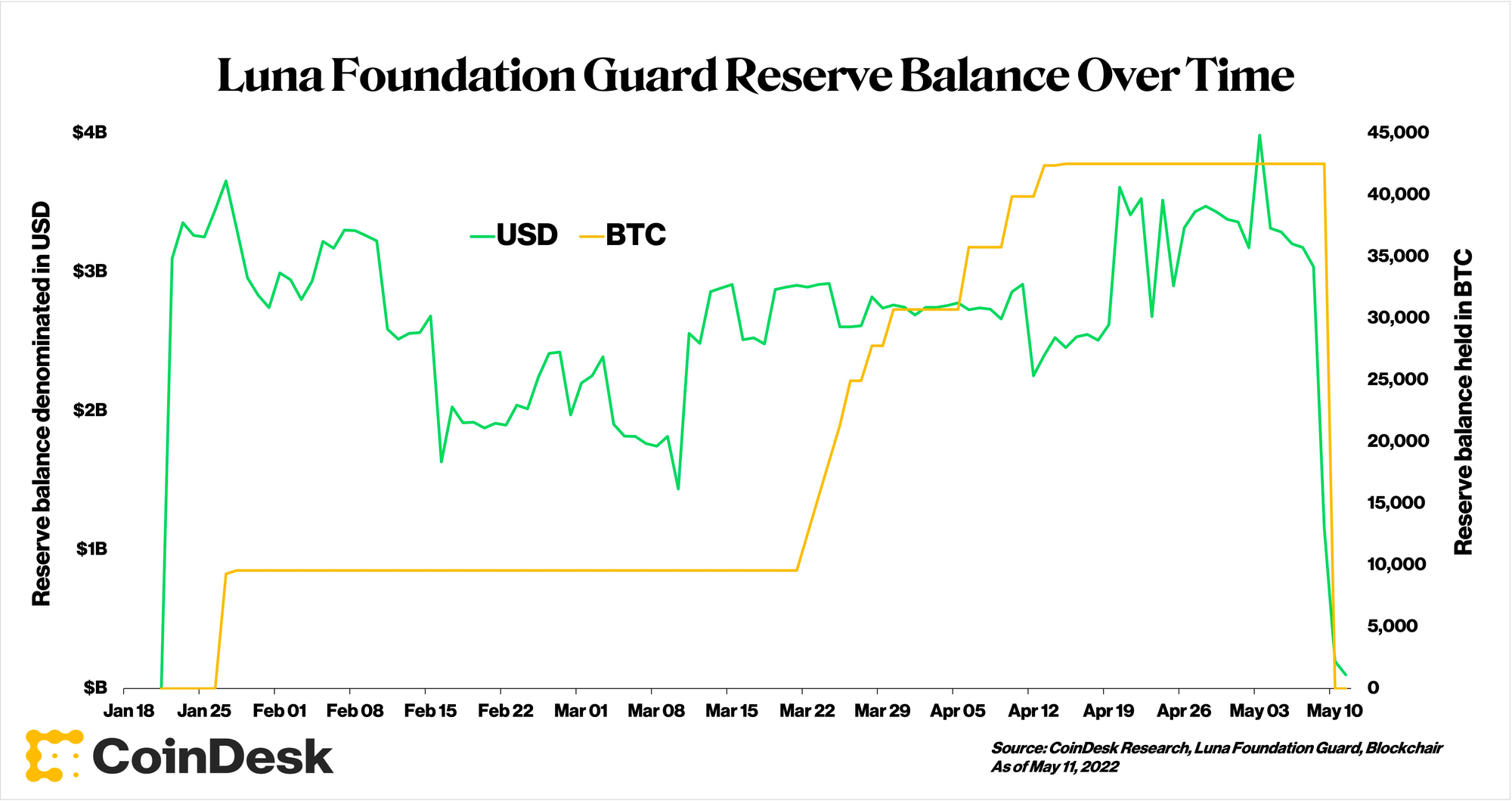

Terra maintained the peg of 1 UST to $1 worth of LUNA through Bitcoin reserves managed by the Luna Foundation Guard (LFG). These reserves, initially valued at $2.3 billion, played a crucial role in stabilizing UST's price. If UST deviated from the peg, LFG would intervene by buying or selling UST to restore parity.

How Terra's Stablecoin Crisis Unfolded:

- On May 7, 2022, global market uncertainties, including a significant interest rate hike by the US Federal Reserve, triggered a sudden unstaking of over $2 billion worth of UST.

- Traders sought to exchange UST for LUNA to capitalize on the peg, but a daily cap of $100 million on burning UST for LUNA hindered large-scale exchanges.

- Unable to exchange UST for LUNA and facing market pressure, UST holders rushed to sell off their holdings, causing a rapid decline in UST's price.

- LFG attempted to restore the peg by loaning out Bitcoin reserves, but the sell-off persisted, depleting reserves to less than $1 million by May 16.

- Terra's blockchain was shut down on May 12, leading to delistings of LUNA and UST on exchanges. On May 14, Terra CEO Do Kwon acknowledged the failure of the UST stablecoin project.

Cryptocurrency Ramifications:

- Terra's collapse contributed to over $15 billion in crypto value disappearing within a week.

- The incident exposed vulnerabilities in inter-reliant crypto ecosystems, triggering seven consecutive weeks of lower Bitcoin prices and extreme fear in market sentiment.

- The failure of algorithmic stablecoins, exemplified by Terra, raised questions about their efficacy and transparency, with potential regulatory scrutiny looming.

- Government officials and regulators, including US Secretary of the Treasury Janet Yellen and SEC Commissioner Hester Pierce, expressed concerns about stablecoin risks, hinting at potential regulatory measures.

While Terra's downfall in May 2022 may not rank as the most devastating crypto crash, it underscored the vulnerabilities and challenges within the cryptocurrency market. The incident prompted a reevaluation of algorithmic stablecoins and intensified discussions on regulatory measures to address risks associated with stablecoin operations. The aftermath of Terra's crisis suggests that future innovations in the crypto space will face heightened scrutiny, emphasizing the need for transparency and regulatory compliance.