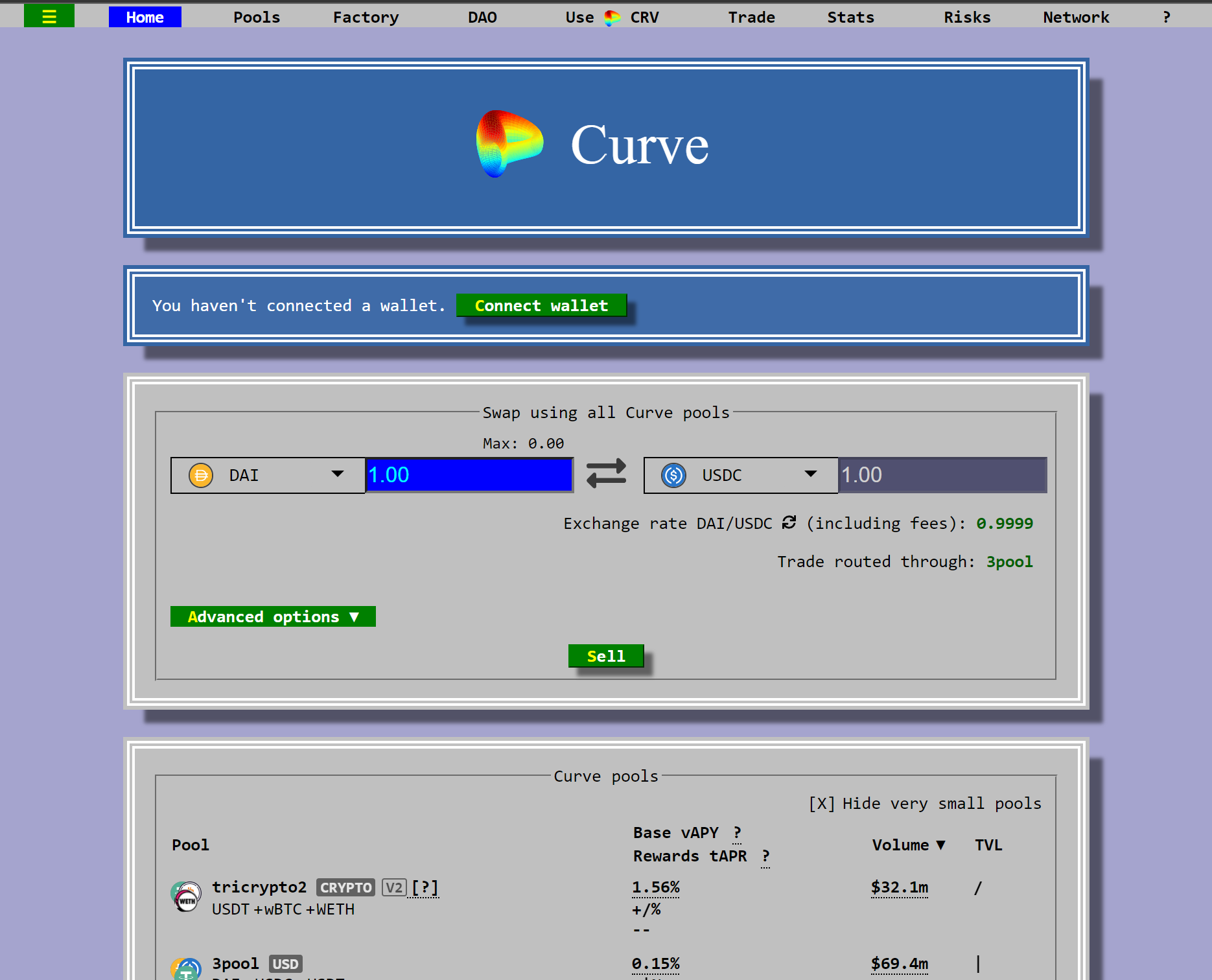

Hacking occurs on the DeFi Protocol Curve.Finance, and 570 thousand dollars are taken.

According to the protocol, the source of the hack has been "identified and rectified." [Creative Commons]

According to a snapshot of the protocol's wallet that was published on Twitter late on Tuesday, cybercriminals stole around $570,000 worth of cryptocurrency from the decentralized finance (DeFi) system Curve.Finance.

The operators of the protocol sent a notification via Telegram not long after that announcement, stating that they had located the cause of the issue and had resolved it. They requested that everyone who has approved any contracts on Curve in the previous few hours cancel their approvals as soon as possible. Users were also instructed by the protocol to switch to using curve.exchange until the propagation of curve.fi returned to its usual state.

Because of the CRV token awards emissions that it generates, Finance is an essential component of the DeFi ecosystem. These emissions provide a source of revenue for a number of other protocols.

The domain name system (DNS) entry for the protocol appears to have been altered by the alleged hacker. As a result, users have been redirected to a phony clone, and a fraudulent contract has been approved. Despite this, the contract for the program was not violated in any way.

As a response to the hack, the protocol sent out a message to users asking them to desist from using curve.fi or curve.exchange until the operators of the protocol find the source of the vulnerability. The message was sent out via Telegram.

The statement that was sent out over Telegram stated as follows: "We are getting aware of a potential front end issue that is approving a bad contract." "For the time being, I would ask that you refrain from performing any approvals or swaps. While we are working to identify the source of the problem, we ask that you refrain from using curve.fi or curve.exchange in the meanwhile.