Founder of MakerDAO Proposes "Seriously Considering" Delinking DAI from USD

Rune Christensen, the founder of MakerDAO (decentralized autonomous organization), has urged the community to think about depegging Maker (MKRstablecoin )'s DAI from USD and maybe (slowly) dipping into ethereum (ETH), which Vitalik Buterin claimed would be a "bad idea."

Christensen wrote to the participants in the DAO's Discord channel, as yearn.finance (YFI) core developer banteg disclosed.

"I believe we should seriously think about being ready to depeg from USD... It is almost certain to occur, and the only way to make it happen realistically is with extensive planning.

The founder explained his thinking behind this viewpoint, mentioning in particular how the US Treasury had sanctioned the well-known mixer Tornado Cash.

The Office of Foreign Assets Control (OFAC) of the Treasury officially outlawed the Ethereum-based cryptocurrency mixing service in the US this week, as was previously reported. Although most people in the community seemed to agree that criminal actors try to use services like Tornado Cash to launder money, many argued that privacy-providing apps are crucial, and the majority felt that the OFAC's move would probably end up being a watershed point in regulation.

Notably, the impacts of the ban were felt right away. The USD coin (USDC) stablecoin's creator, Circle, started freezing tokens with about USD 75,000 of the stablecoin linked to Tornado.

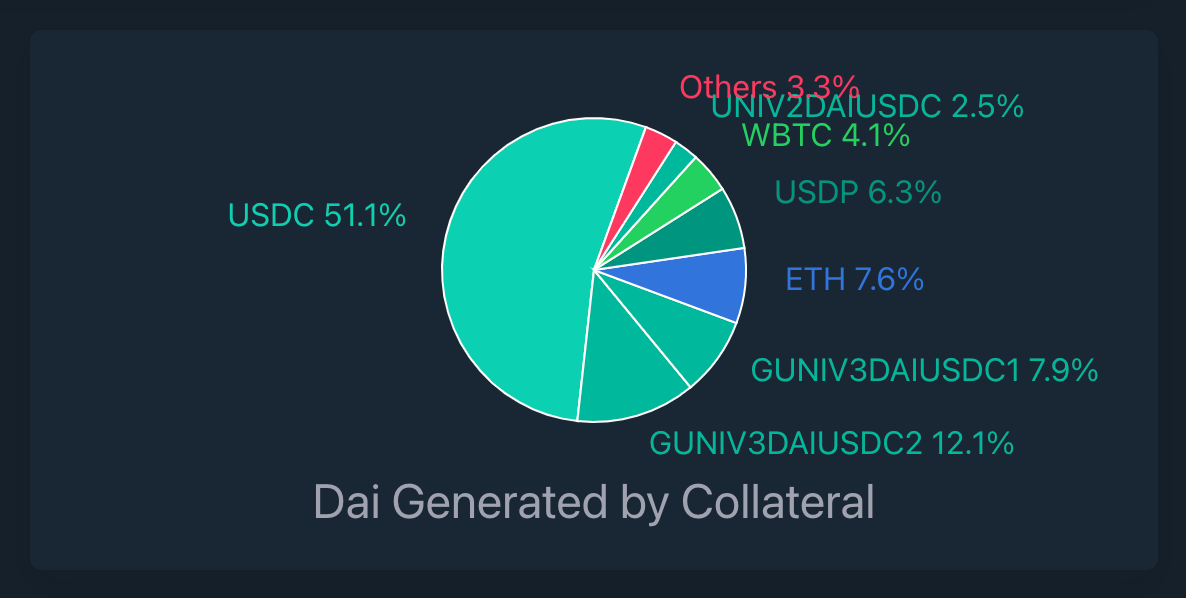

This is important because, according to Dai Stats, USDC serves as collateral for almost 50% of DAI.

Christensen explained as follows:

"I've been looking into the effects of the [Tornado Cash] punishment more, and regrettably, they are far worse than I first anticipated."

USD peg

— Rune (@RuneKek) August 9, 2022

Non-USD linked collateral

Scalability

pick 2

On Thursday, developer banteg published another article stating that MakerDAO is contemplating transferring its USDC from the peg stability module into ETH.

MakerDAO is considering a $3.5 billion ETH market buy, converting all USDC from the peg stability module into ETH.

— banteg (@bantg) August 11, 2022

This is unsafe, according to Vitalik Buterin, co-founder of Ethereum, who also called it a "bad idea." Should the value of the collateral significantly decline due to a significant reduction in the price of ETH, additional problems and negative effects are likely to arise.

Justin Sun, the founder of Tron (TRX), concurred.

I have to agree 👀 https://t.co/YrlIgWHR8U

— H.E. Justin Sun🌞🇬🇩 (@justinsuntron) August 12, 2022

Importantly, Christensen noted that,

“What I actually wrote in the maker governance discord was that yoloing all the stablecoin collateral into ETH would be a bad idea.”

However, he did add that one alternative "that can be considered" is gradually transferring some collateral into ETH.

What I actually wrote in the maker governance discord was that yoloing all the stablecoin collateral into ETH would be a bad idea kek

— Rune (@RuneKek) August 11, 2022

At 9:50 UTC, MKR is trading at USD 1,090, down 2% from the previous day but up more than 3% from the prior week. DAI, with a market valuation of USD 6.95 billion, is the fourth stablecoin according to CoinGecko.