DeFi has become the primary arena for cryptocrime

Diamond Blockchain Says

According to a new analysis, hackers and con artists have moved their focus from penetrating centralizing corporations to targeting decentralized enterprises.

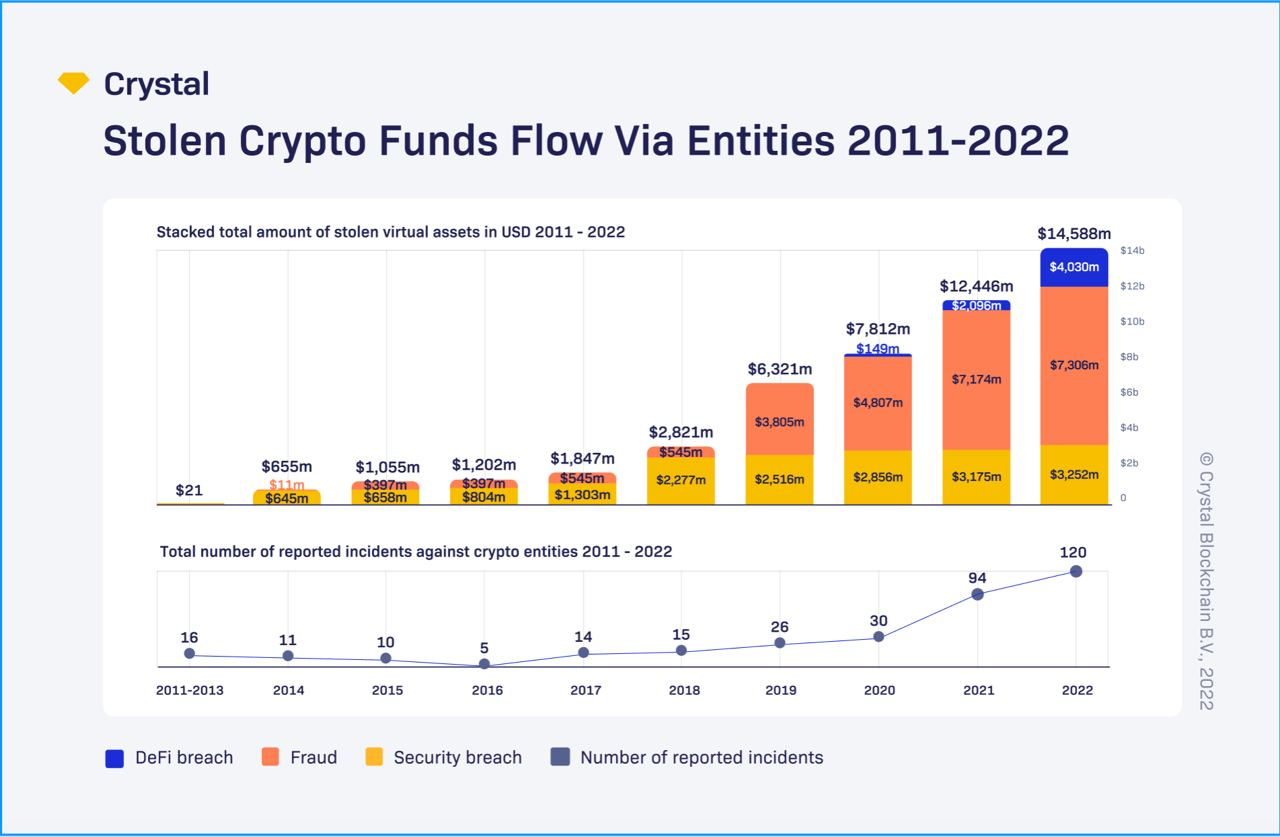

Since 2011, more than $14.5 billion in crypto has been lost to hacks and frauds, and Crystal Blockchain reports that DeFi (decentralized finance) is the new preferred target of attackers.

According to a new analysis by Crystal, there have been 167 hacks of DeFi protocols and 123 security breaches on centralized exchanges during the past eleven years. While breaches of centralized platforms were responsible for over $3.2 billion in stolen crypto, more over $4 billion was siphoned from exploited DeFi projects. The remaining billions were stolen by con artists.

Since 2021, hackers' focus has significantly switched towards decentralized protocols. This year, decentralized projects were attacked 20 times more frequently than centralized ones, according to the research, and the top 10 DeFi hacks stole more than $2.5 billion.

Nick Smart, director of blockchain intelligence and statistics at Crystal, told CoinDesk that the expansion of the industry is the primary cause of the increase in attacks against DeFi companies. While initiatives are racing to market with inadequate testing, he said, centralized exchanges are upgrading their security in response to user demand and increased regulatory scrutiny.

Smart stated,

"There is a saying that nothing is unhackable; all you need is sufficient time, ability, and ingenuity." And some criminal hacking groups, such as the nation-state-backed Lazarus in North Korea, are highly effective and focused on exploiting such possibilities.

CoinDesk - UnknownType of Cryptocurrency Market Crimes / Crystal Blockchain "Until 2021, the most common way of crypto-theft was the compromise of crypto-exchange security systems, but the trend has shifted to DeFi hacks," the paper states. Currently, CEX hacking do the least amount of financial damage. The largest theft of a CEX (centralized exchange) occurred in 2018, when 535 million NEM tokens were stolen from Coincheck.

The largest DeFi assault was the Ronin network hack in March, when over $650 million worth of crypto was laundered using the Tornado Cash mixer from the famous Axie Infinity NFT (non-fungible token) game. According to Crystal, the service received approximately 350,000 ether (ETH) in the first half of 2022, which is more than half of all ETH that ever passed through Tornado Cash.

Read further: The Ronin Attack Demonstrates Cross-Chain Crypto Is an Excessive 'Bridge' In addition to cyberattacks, around 74 fraudulent schemes have exploded on the cryptocurrency market since 2011, resulting in criminals receiving over $7.4 billion, according to a report.

In so-called 'rug pulls,' the creators of a project either flee with their users' funds or dump the coin they developed on the community. According to Crystal, rug pulls became the most prevalent type of fraud in 2022. Out of 36 occurrences of fraud, 34 involved rug pulls, with the majority occurring on Binance Smart Chain (BSC), a blockchain network operated by the world's largest centralized exchange Binance. Crystal stated that 23 rug pulls out of 34 occurred on BSC.

However, the most dollars have been taken from the Ethereum blockchain, perhaps because it is the most popular DeFi platform overall. Crystal stated that it is followed by Solana, Binance Smart Chain, Fantom, and Polygon.

On Ethereum, $31 million worth of cryptocurrency had been taken through scams and rug pulls, while $26 million on Binance Smart Chain, $10 million on Solana, and $2 million on Fantom had also been lost.