6.8 billion dollars will be invested in crypto lending

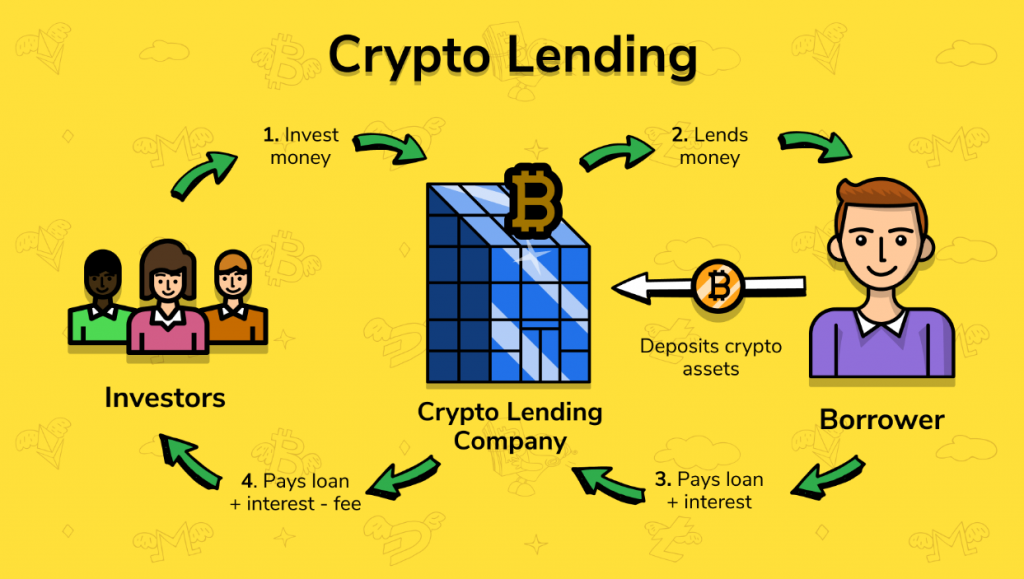

Fairfax County Retirement Systems, a US pension fund with USD 6.8bn in assets, is looking to participate in crypto lending markets to boost its returns, indicating that some significant financial firms are not scared off by the prolonged market collapse.

Katherine Molnar, CIO of the Fairfax County Police Officers Retirement System, told the Financial Times that yield farming yields are appealing since some investors have withdrawn.

The fund's CIO said, "Those ready to supply liquidity, decent profit seekers, can earn more appealing rates now."

The pension fund recently invested USD 35m in Parataxis Capital's digital yield fund and VanEck's new finance income fund to earn income for investors through short-term lending arrangements with crypto asset businesses.

This isn't the fund's first blockchain investment. Its two subsidiaries, the $5bn Fairfax County Employee Retirement System and the $1.8bn Fairfax County Police Officers Retirement System, invested in the Morgan Creek Blockchain Opportunities Fund in 2019. The decision was made a year after managers first heard about cryptoassets and investor potential.

Molnar: "At a conference, a professor who teaches the issue spoke." The technology's goods intrigued us.

"We stand by our initial thesis," she said. Stronger technologies will likely survive.

Pension funds are typical financial entities that embrace crypto investments. Despite market volatility, PwC reports that more US hedge funds are investing in cryptoassets. Traditional hedge funds invested 38% in digital assets that month, up from 21% a year earlier.